The Power of Tax Reviews

- Diagnostax

- Jan 24, 2024

- 4 min read

Tax can be overwhelming. With all the legislation, HMRC manuals, deadlines, and documentation, it’s no wonder a lot of accountants shy away from providing tax advice services to their clients. Or if they do provide it, they tend to outsource.

But we are here to say that tax can be made simple. It’s about the fundamentals which accountants use, which impact the overall tax planning for clients.

And when it comes to where to start with tax, we swear by tax reviews.

Tax reviews are fundamental when it comes to effective tax planning.

So it’s through this blog that we will provide insight into the title of this post ‘The Power of Tax Reviews’.

Tax Reviews Optimise Tax Efficiency

It’s common for accountants to use tax reviews to proactively spot tax opportunities for their clients; as spotting tax opportunities and acting upon them, will improve tax efficiency. But what we have found is that it’s not so much about the amount of tax opportunities that you can identify, but ones that are relevant to the individual and their business.

The reason for this is that personal and business circumstances differ for everyone. Here’s why:

Business

Every business is at a different stage of their lifecycle, whether they are just starting up, maintaining, growing, expanding, or even concluding. A business’s lifecycle is fundamental to their tax efficiency. This is because, as businesses progress through their business lifecycle, there are different options for tax advice to consider to maximise their tax efficiency.

That’s why it is important to conduct a tax review that is specific to the business's lifecycle stage.

Now, there are five key stages of a business’s lifecycle, these being:

Start up

Stable Business

Growing Business

Expanding Business, and

Concluding Business

The image below provides a summary of the tax reviews for each of these stages.

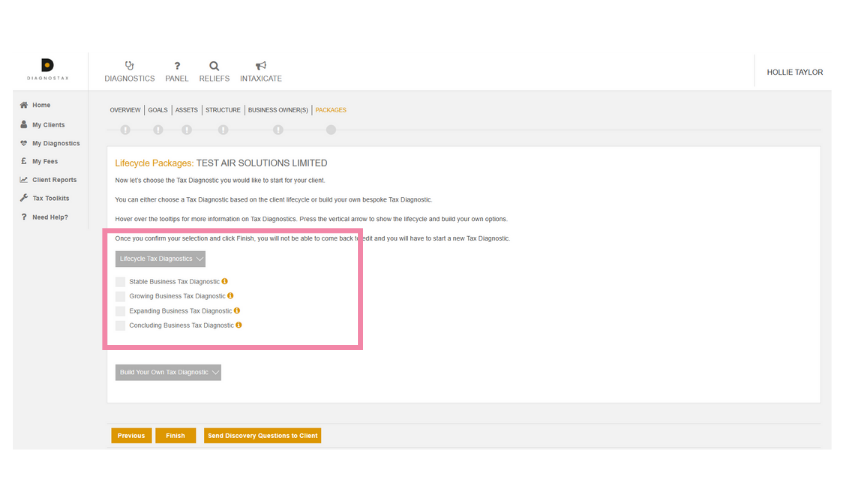

The Tax Diagnostic Software has these five business lifecycle stages embedded within the software. This enables our users to select a Tax Diagnostic Review (what we call tax reviews) based on a business’s lifecycle stage or, they have the option to complete a fully bespoke tax review.

Business Lifecycle-Specific Tax Diagnostic Reviews:

Build your own Tax Diagnostic Review:

Personal

No one starts a business purely for financial reasons. Their intrinsic motivators play a factor too such as, the thrill (and stress 😅) of running a business, increased flexibility with their work-life balance, and achieving their personal goals, for example, early retirement or passing the business down to their loved ones.

Knowing these factors means accountants can identify the relevant tax opportunities for their clients which are specific to reaching their personal goals as well as benefiting the business.

Our Tax Diagnostic Reviews include ‘Discovery Questions’ throughout. These questions are to understand an individual's current position and their future goals. For example, are they married? Do they have kids? When do they want to retire? This enables our users to conduct a tax review that is specific to a business's lifecycle stage but also highlights the relevant tax opportunities based on their personal goals.

Tax Reviews Highlight the Need for Specialist Tax Advice

Tax reviews can identify a lot of opportunities, 200+ in some cases. But what if accountants feel they are lacking in tax knowledge? Or haven’t had enough exposure in that specific area of tax? Or simply don’t have the time amongst other priorities to provide accurate tax advice?

Tax is complex. With over 17,000 pages of tax legislation, it can be difficult for an accountant who has had exposure to a lot of tax work, or even CTAs in some circumstances, to have full confidence in the tax advice they give to their clients. There’s also the risk that sits with the individual who provides the tax advice; so, it is vital to provide both accurate and compliant tax advice.

This is where accountants seek formal tax advice from an external provider. Doing so means they are still providing tax advice to their client, despite having barriers. After all, their clients trust their accountants to provide services that benefit their business, optimise their current financial position, and keep in mind their future.

The Tax Diagnostic Software has a feature which allows users to allocate the tax advice opportunity to the relevant stakeholder. Whether it’s the accountant/advisor, their client, or the need for a Tax Specialist. This provides a bird's eye view of all the tax opportunities identified, enabling effective allocation and prioritisation of tax opportunities.

Tax Reviews Identify Tax Saving Opportunities

Tax reviews aren’t just useful in spotting the amount of tax opportunities. They also identify estimated tax saving opportunities. Understanding the world of tax can be overwhelming but knowing how the tax system works means accountants can take a proactive approach in their clients' tax planning.

So when it comes to tax savings, say hello to Tax Relief Schemes.

But not everyone can unlock tax relief, or tax savings, they need to be eligible to do so. But how do accountants know if their clients are eligible? Luckily, due to advancements in digital technology and the support of teams like our own here at Diagnostax, working out whether clients are eligible has never been easier.

Take for example, this stat:

26% of Company Tax Diagnostics reveal R&D

This stat shows how in 2023, 26% of Company Tax Diagnostics completed within the Tax Diagnostic Software revealed R&D.

With R&D Tax Relief being one of the most common business Tax Relief Schemes, having software that can help identify this, makes an accountant’s job a lot easier.

But when it comes to whether these tax-saving opportunities are indeed eligible, we would always recommend speaking to a specialist.

Conclusion: A Powerful Place to Start

Tax reviews are a powerful place to start if accountants don’t know where to start when it comes to proacive tax planning for their clients.

Tax reviews create a roadmap. Milestones and objectives. All of which are achievable (providing enough time is left to obtain). Through completing a tax review, accountants discover what it is they need to do and the necessary next steps in order to maximise their clients' tax efficiency.

And increasing tax efficiency means more savings. More savings means satisfied clients. Satisfied clients mean positive impacts on client retention; one of the main goals for all accountants.

Want to find out more about the use of digital tools within the accountancy and finance industry?

We recommend you read our blog on Empowering Advisors to Provide Effective Tax Advice with Technology.

Commentaires